non recoverable draw against commission

Recoverable Draw v Non-Recoverable Draw Against Commissions. In the case of a non-recoverable draw you pay them a.

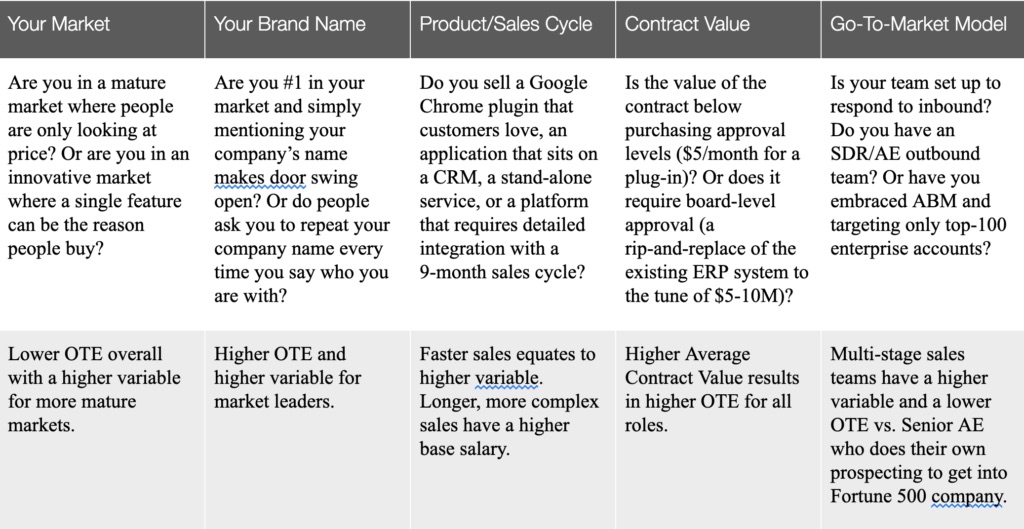

Sales Commission Key Terminology And Definitions Sales Commissions Explained

And your rep has to earn 2500 in commission the following month to make up for the previous months loss.

. You can think of a non-recoverable draw against. Non-recoverable draws occur when a sales rep doesnt earn enough commission to cover their draw amount. Say I work for ABC.

A draw against commission offsets the lack of incentive payments during a sales reps ramp and onboarding. Posted on March 6 2018 Author sacemploymentlawyer. These funds are typically deducted from future commission earnings.

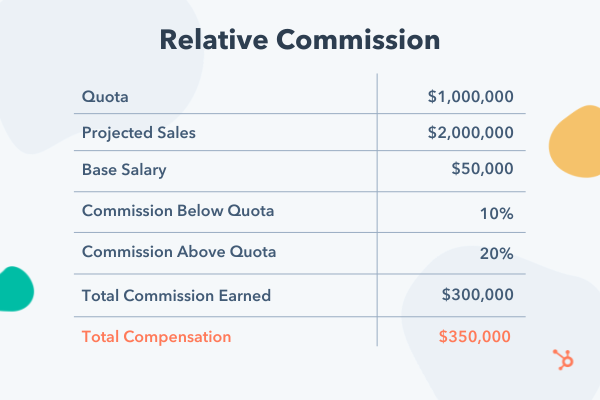

A draw against commission works like this. This is a recoverable draw. An employee falling short of sales goals withdraws money from a guaranteed draw up to an amount equaling the difference between his earned.

It is an advance payment to the salesperson which the company can no longer recover. A non-recoverable draw occurs when the salespersons commissions are less than the draw amount and the draw monies are not returned or carried forward. A non-recoverable draw is a loan that can be taken out to help you make a living.

The rep typically gets to keep their advance but this. The business sets a non-recoverable draw amount of 2000 for Agent X per commission. A non-recoverable draw often called a non-recoverable draw against commission is a common element of sales commission plans.

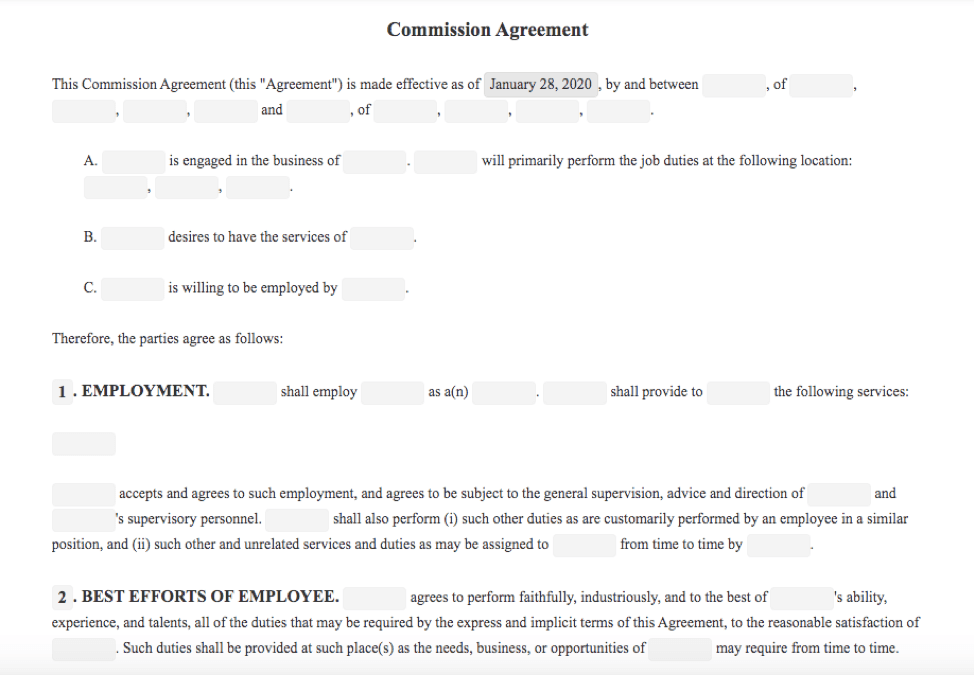

A non-recoverable draw is a draw against future commissions that doesnt have to be paid back to the employer. There are two types of draw - a recoverable draw and a non-recove. The Company shall pay the Employee a non - recoverable draw at the annual rate of not less than Fifty Thousand Dollars USD 50000.

Recoverable draws are most often used for positions with longer sales cycles to help new sales reps earn. A non-recoverable draw is also a fixed amount paid in advance of earning commissions but functions more as a minimum guaranteed periodic payment to the employee. A non-recoverable draw is a draw against future commissions that doesnt have to be paid back to the employer.

Non Recoverable Draw Against Commission. Non-recoverable draw Non-recoverable draws are still paid out of commission but if the employee does not earn enough in commissions to pay back the draw there is no. Many sales peoples compensation in California is structured as a draw against commissions.

Solely for the period September through December of 2011 and upon the achievement of specific objectives established by ServiceSource Employee will be eligible to receive a non -. The typical sales draw against commission is built to help a. Categories Wages Overtime.

Once their draw balance has been paid off entirely they will receive the full amount of their commission. During times of economic uncertainty changing selling conditions.

What Is Draw Against Commission In Sales Everstage Blog

Bonus Vs Commission What Are The Major Pros And Cons Of Each Qcommission Is A Powerful Flexible Sales Commission Software

6 Sales Commission Structures You Should Know Free Calculator Inside

The Ultimate Guide To Sales Compensation New Data

What Is Draw Against Commission In Sales Everstage Blog

What Is A Draw Against Commission Examples More

What Is A Sales Commission Draw Sales Commissions Explained

For Commission Only Sales People Should We Offer A Draw

How Does A Draw Work In Sales A Comprehensive Overview

10 Sales Commission Structures How To Decide What S Best

Top 10 Sales Commission Structures Closers Into Leaders

Recoverable Vs Non Recoverable Draw What Is The Difference Qcommission Is A Powerful Flexible Sales Commission Software

11 Sales Commission Structures And How They Work In 2022

How To Manage Commission Draws And Advances Core Commissions

How To Create Sales Commission Plans With Examples

What Is Draw Against Commission In Sales Everstage Blog

Qcommission By Cellarstone Inc Qcommission1 Twitter